Qualcomm: 5G + Patent Portfolio = Big Upside

Despite the strong performance over the last year, Qualcomm shares have a lot more upside potential ahead. Specifically, the continuing wave of 5G connectivity, combined with Qualcomm’s significant competitive advantages, make the shares attractive. In this report, we review the business, the unique licensing model, the Nuvia acquisition, valuation and risks, and then conclude with our opinion on investing.

Overview:

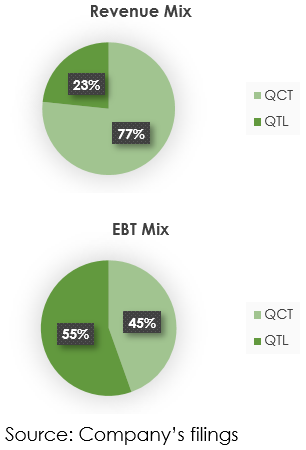

Headquartered in San Diego, California, Qualcomm is engaged in the business of providing wireless technology solutions and intellectual property. The company has 41,000 employees and nearly 13,000 customers across multiple industry verticals and 40+ countries. Qualcomm’s technologies and products are used in mobile phones, smartwatches, laptops, network equipment, automotive telematics and infotainment systems, and other IoT devices. The company’s registered trademarks include Qualcomm, Snapdragon, MSM, Hexagon, and Adreno. Qualcomm operates primarily under two operating segments, Qualcomm CDMA Technologies (“QCT”) and Qualcomm Technology Licensing (“QTL”). QCT accounts for the majority of the company’s revenue (76.6%) while QTL accounts for the majority of the profits (EBT share: 55.5%). More details about the company’s key segments is presented below:

QCT (Qualcomm CDMA Technologies): In this segment, the company sells integrated circuits and system software based on 3G, 4G, 5G or other technologies for use in IoT and other wireless connected devices such as Snapdragon platform for mobile and automotive, Hexagon™ processors, Adreno™ GPUs, etc. It also sells RF front-end (“RFFE”) products used in various IoT devices to reduce power consumption and to improve radio performance. The majority of QCT’s revenue comes from the sale of products used in handsets.

QTL (Qualcomm Technology Licensing): In this segment, Qualcomm derives revenue from royalties or from granting licenses and rights for use of the company’s intellectual property for manufacturing certain wireless products, including products using CDMA2000, WCDMA, CDMA TDD, LTE or OFDMA-based 5G standards and their derivatives. The segment has an EBT margin of 68%.

Unique licensing business model

Qualcomm has a unique, yet controversial business model which is commonly referred to as “no license, no chips”. Under this business model, Qualcomm’s competitors are allowed to sell chips that are manufactured using Qualcomm’s patented technology only to the customers (phone manufacturers like Apple (AAPLY, Huawei) who have licensed the patents from Qualcomm. Thereby, forcing phone manufacturers to buy a license from Qualcomm even if they do not buy chips from Qualcomm. This has led to a lot of criticism from smartphone makers, thus resulting in lawsuits. With that said, the companies have been forced to pay Qualcomm royalties and license fees due to its ‘industry-standard’ technology patents which are often regarded as essentials. Both Apple and Huawei, who had refused to pay royalties to Qualcomm earlier, dropped their litigation in April 2019 and July 2020 respectively. Moreover, they subsequently entered into new multi-year licensing partnerships with Qualcomm and paid a hefty lump-sum payment as per the settlement agreement, which included previously unpaid royalties.

In August 2020, the company won an FTC antitrust case for this unique licensing business model. In 2019, a U.S. District Judge had ruled in favor of the FTC due to which Qualcomm could have faced a large hit to its license revenue. However, the recent win reversed the previous ruling and has validated the company’s licensing business model. The court defined the strategy as “hypercompetitive” and not anticompetitive.

Please note that the Apple-Qualcomm saga may have a few more chapters ahead as Apple is working on in-sourcing more of the semiconductor components for its phones. This may lead to some loss of revenue for Qualcomm in the medium to long term. However Qualcomm’s dominance in smartphone and 5G technologies means that it will be difficult to eliminate the company from the Smartphone supply chain in any noticeable way.

Long-awaited 5G tailwind helping regain growth momentum

As per the company’s 2019 analyst day presentation, Qualcomm’s Serviceable Addressable Market (SAM) is expected to grow at a 3-Year CAGR of 15.4% from $65B in 2019 to $100B in 2022. Included in SAM, the handset market is estimated to grow at a 3-Year CAGR of 10% from $26B in 2019 to $35B in 2022, IoT market is expected to grow at a 3-Year CAGR of 7% from $17B in 2019 to $21B in 2022 while RF front-end and the automotive market are expected to grow at a 3-Year CAGR of 12% each. Overall, there is a lot of growth here.

Having said that, we expect the company to see much faster growth in the near to medium term as the 5G transition gains momentum. The transition from 4G to 5G is expected to be a significant upgrade due to extremely low latency, 100 times increased in traffic capacity, and network efficiency and up to 100 times improvement in speed. The strong value proposition would lead to a much faster 5G rollout and increased sales of mobile handsets as users have a major incentive to upgrade to 5G. Additionally, it will lead to increased application of wireless networks in the automotive industry as well as manufacturing, energy, logistics, gaming, and healthcare industries. Broader applications across multiple industry verticals would result in greater market opportunity for Qualcomm. Moreover, increased sales of smartphones would result in boosting Qualcomm’s chipset sales and license revenue. It would also lead to increased revenue per handset due to improved technology. The company described 5G as “the single largest opportunity in our history” on its Q4 conference call.

Dominating the market by being on the front lines of innovation

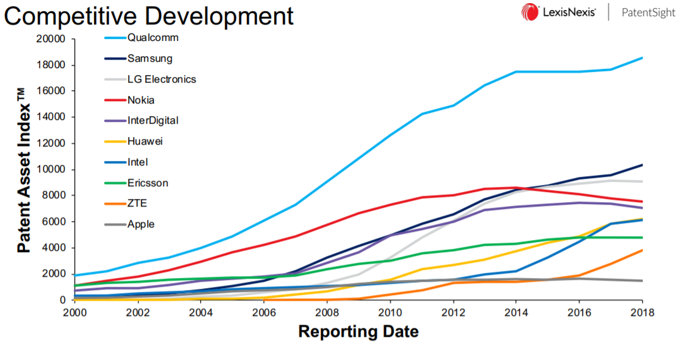

Qualcomm has dominated the wireless space with its industry-leading technology. It has an intellectual property portfolio of more than 140,000 current and pending patents and is continuously investing heavily in R&D which stood at nearly 20% of revenue in FY2020. So far, the company has invested over $60B in R&D activities. This has helped the company stay on the front-line of innovation and ahead of its competitors.

The company’s competitors include Broadcom (AVGO), HiSilicon, MediaTek (MDTKF), Nvidia (NVDA), NXP Semiconductors (NXPI), Qorvo (QRVO), Samsung (SSNLF), Skyworks (SWKS), Texas Instruments (TXN), and UNISOC. It also competes with Huawei, Nokia (NOK), and HTC (HTCKF) in mobile technology solutions.

While competition is fierce, the company is uniquely positioned due to its strong patent portfolio that allows it to dominate the market and earn royalties from each product that is manufactured using its patented technology (even by its competitors). As per IPWatchdog’s presentation in 2019, Qualcomm holds the largest patent portfolio in terms of value, surpassing its next competitor by a significant margin.

Even as per the IEEE Spectrum website, Qualcomm ranks #1 in the communication/internet equipment sector with more than double the score of the next competitor in terms of patent value.

The company’s closest competitor is MediaTek with both companies holding a market share of nearly 30% each in the mobile phone chipsets market. Having said that, Qualcomm enjoys strong market leadership in the 5G chipset market with a 39% market share as of Q3 2020. Due to leadership in 5G, the transition from 4G to 5G will also enable the company to capture a much larger market share in the overall chipsets market. In November 2020, Qualcomm introduced Snapdragon 888 mobile platform to enhance its 5G capabilities. It will help lower device costs and increase battery life. The company also recently launched Snapdragon 480 5G chipset to bring 5G capabilities to budget smartphones. This initiative will help Qualcomm increase market penetration in emerging markets as well.

Nuvia’s acquisition to further amplify Qualcomm’s technology edge

Qualcomm has recently announced the acquisition of Nuvia, a company that is focused on designing high performance processors. While the acquisition was for $1.4B which is less than 1% of Qualcomm’s market cap, we believe the acquisition will play a much larger role strategically.

Nuvia’s CPU designs are expected to power Qualcomm’s snapdragon (mobile SoC), laptops as well as other IoT devices with distinct industry applications such as Automotive. Nuvia’s CPUs directly compete with ARM’s processor IP. Therefore, the acquisition will help reduce Qualcomm’s dependence on ARM for licensing computing cores as well as help lower licensing costs paid to ARM which has now been acquired by Nvidia, Qualcomm’s competitor. We recently shared a report and video on Nvidia (including a discussion of the ARM acquisition) here and here.

Both top-line and bottom-line to see resurgence

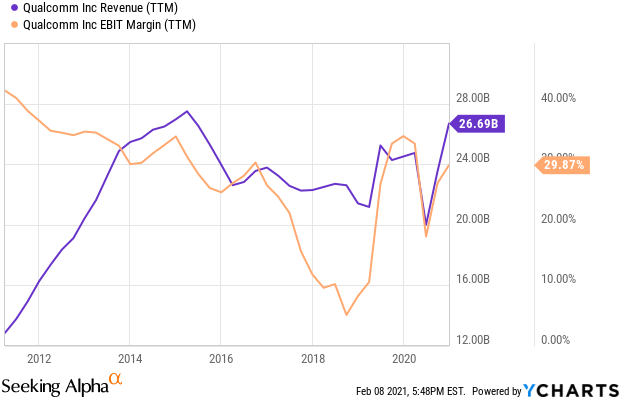

Qualcomm delivered subpar revenue growth in recent years due to a lack of significant technological upgradation as well as legal cases with a few notable customers. Revenue fell at a 5-Year CAGR of -1.4% and EBIT margins contracted significantly from FY2015 to FY2020.

With that said, we expect the company to regain growth momentum due to the 5G transition and the reinforcement of its licensing business model.

In fact, revenue in Q1 2021 was up 62% Y/Y to $8.24B. And according to CEO Steve Mollenkopf:

“We delivered an exceptional quarter, more than doubling earnings year-over-year due to strong 5G demand in handsets and growth in our RF front-end, automotive and IoT adjacencies, which drove record earnings in our chip business…” and “We remain well positioned as the 5G ramp continues and we extend our core technology roadmap to adjacent industries.”

And due to improved technology, chipsets pricing is expected to become more expensive, thereby resulting in improved profitability along with higher revenue. Additionally, increasing applications across multiple industries is likely to fuel demand further.

Access to adequate growth capital with solid cash flows and balance sheet

Qualcomm has a robust financial position with a liquidity position of $12.3B, including cash, cash equivalents and marketable securities, and a net debt position of $15.7B as of December 2020. We believe the company’s strong cash flows and balance sheet metrics will help support incremental R&D, capital expenditure and inorganic initiatives which might be required to capture the full benefit of the 5G tailwind. Moreover, the company has also bought back nearly 25% of its outstanding shares since 2016 for $30B to enhance shareholders’ wealth.

Valuation remains attractive

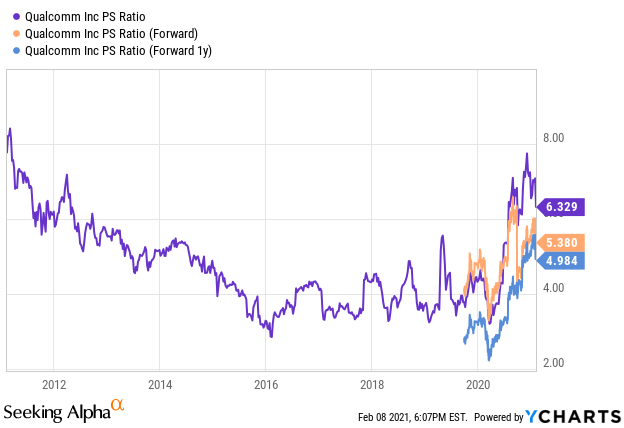

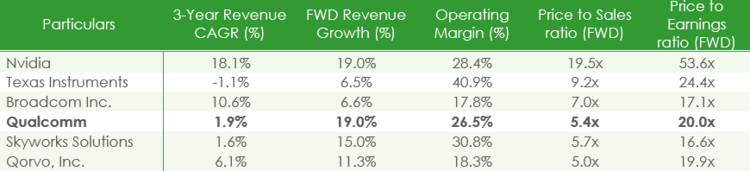

Qualcomm shares have gained 68% over the last 1-year driven by strong 5G tailwinds and big legal wins, resulting in the stock trading at a price-to-sales ratio (TTM) of 6.3 times compared to its 5-Year average of 4.8 times.

Having said that, the stock is still trading at an attractive forward price-to-sales multiple of 5.4 times considering its strong operating margins and double-digit expected revenue growth.

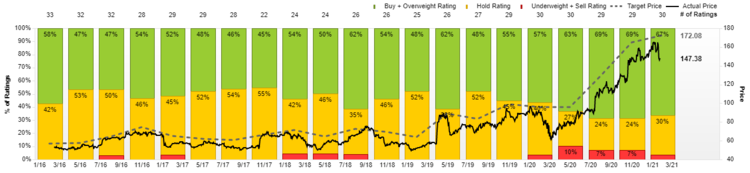

For a little more perspective, two-thirds of the Wall Street analysts covering the shares rate Qualcomm a “Buy,” and have a $172 price target (implying 17.4% upside versus the current market price).

However, we believe the upside is dramatically greater based on the massive long-term 5G market opportunity and the company’s strong competitive advantages, as described above.

Customer Concentration Risk:

One risk Qualcomm has to content with is customer concentration risk. Specifically, Qualcomm’s top four customers account for nearly half of the company’s revenue. The loss of a major customer could have a disproportionate impact on the company’s financial outlook. Having said that, Qualcomm’s indispensable technology and unique licensing business model limits this risk significantly.

Conclusion:

Qualcomm is one of the most attractive plays in the 5G ecosystem. And as 5G grows, we expect Qualcomm’s industry-leading position to result in increased product pricing and significant profitability gains. Further, the shares trade at an attractive valuation multiple, thereby offering a compelling risk-reward opportunity, and this leads us to rank Qualcomm as one of our top ideas in this month’s installment of The Chosen. If you are looking for a highly attractive growth stock, Qualcomm shares are absolutely worth considering.