Farfetch: Post-Pandemic Upside

Farfetch (FTCH) is one of the largest e-commerce solutions for luxury goods, and it is growing rapidly thanks to its significant, technology-enabled platform that is not easy to replicate. Further, the company is well placed to benefit from the ongoing digital shift, which is accelerating because of the ongoing global pandemic. Despite near-term economic uncertainties, the asset-light business model remains intact and is quite valuable. This article reviews the business, the opportunity, profitability, valuation and risks. We conclude with our opinion on investing.

Overview:

Launched in 2008 by José Neves, Farfetch began its journey as an e-commerce marketplace primarily designed to connect luxury boutiques with global customer, and it has now grown into one of the largest online platforms for luxury fashion goods with more than 2 million active consumers spread across 190 countries and over 1,200 brands and boutiques from more than 50 countries. The company also offers platform solutions to luxury fashion retailers. These solutions include a personalized e-commerce website for the retailer to better reach customers and improve brand image. While the digital e-commerce platform remains the core business for Farfetch, it also owns and operates physical retail businesses which include Browns, Stadium Goods, and Off-White. Farfetch also owns New Guards, which provides an incubation platform for budding luxury fashion brands to scale up. New Guards’ portfolio of brands includes Off-White, Heron Preston, Palm Angels, and Marcelo Burlon. Off-White has been ranked the “hottest brand” in fashion for last 3 consecutive quarters by The Lyst Index.

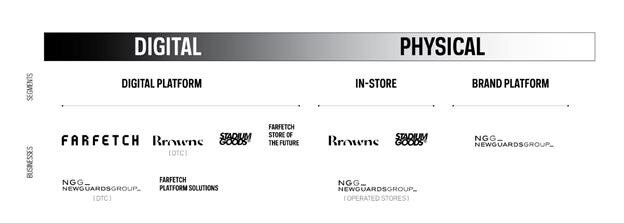

Farfetch conducts its business through 3 operating segments:

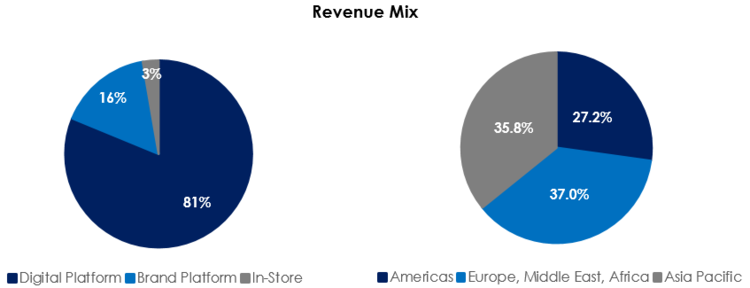

Digital Platform Segment: This is the core segment for Farfetch. It includes all the online sales channels operated by the company such as its marketplace e-commerce website, platform solutions, e-commerce websites of its retail businesses as well as individual websites of the portfolio brands of New Guards. Revenue in this segment is generated from commissions earned from third-party sales. To a lesser extent, Farfetch also makes first-party sales in this segment and records the entire GMV of first-party products as revenue. Further, this segment also includes fulfillment revenue, which are basically charges related to shipping and custom clearing services provided to customers. Digital Platforms is the largest segment for the Farfetch and contributes more than 81% of overall revenue.

Brand Platform Segment: This segment includes operations of New Guards portfolio brands. The operation includes design, production, and wholesale distribution of branded products. Online sales and owned retail store sales are not included in this segment.

In-Store Segment: This segment consists of Farfetch’s owned and operated stores including Browns, Stadium Goods, and some of the New Guards portfolio brands.

Luxury Goods: A structural shift towards online retail

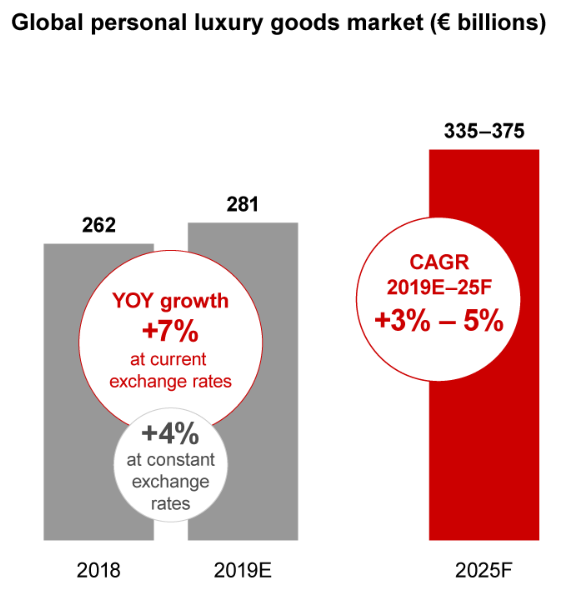

The global luxury goods industry has been an outperformer, with growth primarily being led by a consistent increase in middle/affluent class incomes and spending levels, especially in the Asian emerging economies. As per the luxury industry 2019 report published by Bain & Company, global personal luxury goods industry likely reached an all-time high revenue of $281 billion in 2019, representing year on year growth of 4% in constant currency.

Asian markets likely outperformed with 17% constant currency growth with Chinese consumers representing a large portion of global growth. Mainland China has been the growth engine of the luxury goods industry and now constitutes 35% of the world’s luxury goods market. Bain estimates the luxury goods market to grow at a CAGR of 3 to 5%, to become an ~$350 billion industry by 2025, with Chinese consumers accounting for 46% of the overall market. Clearly, the COVID-19 crisis will impact this growth in the near term, however the long-term growth trajectory is still intact. In order to tap the growing luxury market in Mainland China, Farfetch has entered into a strategic partnership with JD.com (JD). Through this partnership, Farfetch has gained an opportunity to make its services available to more than 300 million customers of JD.com. Additionally, Farfetch also acquired CuriosityChina, a marketing company specializing in digital and social media marketing in Mainland.

Further, there has been a steady shift in the industry’s customer base from Generation X to Generation Y (born between 1980 and 1995) and Generation Z (born after 1995). Gen Y and Gen Z (which accounted for 39% of the luxury goods consumption in 2019) are estimated to account for 55% of purchases by 2025.

An increased number of retailers are moving towards digital platforms to meet the needs of technologically savvy newer generations that prefer to shop through e-commerce websites. In 2019, e-commerce was the fastest-growing luxury goods sales channel, clocking a YoY increase of 22%. Online sales now contribute 12% of the total luxury goods sales and are estimated to reach 30% of the overall market by 2025. Farfetch, being one of the largest e-commerce platforms in luxury, is well placed to gain from this structural digital shift.

Pandemic accelerates long-term shift to online

While COVID-19 has negatively impacted wealth and incomes globally, it has also accelerated the shift of maket share from offline to online retail as consumers embrace social distancing. Digital presence and e-commerce platforms have become more essential than ever in the post-pandemic reality as retailers are looking for non-traditional ways to reach their customers in order to make up for lost in-store sales as a result of declining footfalls. Additionally, emerging market consumers that face difficulty travelling abroad due to lockdowns will move some of their spending from the travel retail channel to online retailers such as Farfetch. In fact, the company did see an unexpected surge in sales in China towards the end of Q1 2020.

“One, the resilience of our business model, which has enabled us to continue serving the industry and our consumers throughout the pandemic with minimal disruption. Two, our market-leading Digital Platform, with shops and department stores remaining largely closed today and likely to have a reduced footprint and presence going forward, we expect online luxury penetration will accelerate, as physical store shoppers seek to make even more of their luxury purchases through digital channels.” – Jose Neves, CEO in Q1 FY20 earnings call.

Asset light model provides a distinct competitive advantage

As the largest e-commerce platform for luxury goods, Farfetch serves as a one stop destination for the requirements of most of its luxury goods customers via its portfolio of 3,400 brands. Farfetch follows an asset light business model which allows it to provide a broad collection of brands to its customers. An asset light business model means that Farfetch does not tie up capital in inventory in its core marketplace business. Rather, it acts as an intermediary between the buyer and seller thereby foregoing some of the major risks that are attached to a typical retail business. Pricing decisions, along with decisions on stock levels and design availability are made by the sellers themselves. Farfetch uses a proprietary integrated system to keep track of stock levels with buyers, warehouses, stock in transit or out on delivery. Farfetch charges a commission equal to 30% of the selling price for the services it provides through its marketplace platform.

The core marketplace business for Farfetch is regarded as a technology platform instead of a typical luxury retail company. It also offers white-label digital solutions to retailers such as a personalized e-commerce platform. Additionally, the digital solutions include several features such as inventory management, data analytics, etc. which helps the sellers to leverage technology to drive better decision making.

Solid growth track record even as near-term outlook uncertain

Farfetch has consistently reported strong growth in revenue in recent years. In fact, the company’s revenue has grown at a CAGR of more than 60% over the last 4 years. This strong growth is primarily driven by a combination of growth in GMV transacted on its platform as well as an increase in number of active clients. Please note that Farfetch’s GMV has grown from $585 million in 2016 to an impressive $2.14 billion in 2019, translating into a CAGR of 54% in the last 4 years. The number of active customers has also increased from a mere 652,000 in 2016 to 2.07 million in 2019.

Important to note, Farfetch could experience slower growth over the next two quarters due to pressure on discretionary spending levels around the world. Additionally, management believes that post pandemic, the competition in the luxury fashion online space may intensify as retailers are expected to mark down prices to move out bloated inventories and maintain market share. This will result in increased pricing pressure on Farfetch’s first-party brands along with suppressed order values in the near term.

“it is important that we continue to keep one eye focused on our longer term plans and one watchful eye on the near-term uncertainty presented by COVID-19. In particular we do not know how consumer sentiment will be impacted by government lockdowns and the resulting macroeconomic impacts and whether relief measures will be sufficient to boost consumer confidence in the near-term. This will continue to have an impact on demand in some our larger markets including the U.S. and parts of Europe. We also expect the competitive environment will intensify as online and offline retailers assist the current stock position and trading stance in the coming weeks. Increased discounting and markdowns will require our sellers to assist their competitive position on Farfetch, which could in turn lead to lower AOVs and a higher cost of delivery as a percentage of GMV.” – Elliot Jordan, CFO in Q1 FY20 earnings call

On the profitability front, Farfetch still generates losses, but is targeting to become Adjusted EBITDA positive in 2021. Although EBITDA losses have widened over the years on an absolute basis, EBITDA loss margins have consistently improved from -28% in 2016 to just over -13% in 2019.

Sufficient liquidity to fund expansion initiatives

Farfetch, as a growing company, has to spend a significant amount of capital to improve its technology as well as fund new business initiatives. As a result, it has not become free cash flow positive yet. The company finished Q1 with a cash balance of $422 million after raising $250 million from Tencent and Dragoneer through the issuance of convertible senior notes. Additionally, Farfetch recently raised $350 million through an issue of 3.75% senior convertible notes. We believe the company’s liquidity is sufficient to meet the near to medium-term investment needs of the business.

Attractively valued given the long-term growth potential

Farfetch went public in 2018 with a market valuation of $6.2 billion. Since then, the company’s valuation has considerably declined primarily because of acquisitions it has made in the last couple years. Farfetch started as pure-play e-commerce marketplace with no inventory risk attached, but the acquisition of New Guards and Stadium Goods led to concerns among investors regarding a strategy shift away from its “asset-light” business model. In our view, the “asset heavy” parts of the business are still small and should not take away from the tech enabled, core platform business of the company. The stock is currently trading at a price to sales multiple of approximately 4.35x. We believe this multiple will expand (good for investors) considering the post-pandemic digital shift (particularly in the luxury goods) along with Farfetch’s solid market position in the space. Further, stabilization in global consumer stability will also allow the multiple to expand.

Risks

Prolonged slowdown: An extended recession or an L-shaped recovery from pandemic slowdown may lead to a larger than expected decline in global discretionary spending and would accentuate promotional cadence in the global luxury goods industry.

Competition: Although Farfetch is the market-leading luxury e-commerce platform, it faces increased competition from big and small e-commerce businesses such as Net-A-Porter, Amazon, and Alibaba, to name a few. In order to overcome the rising competition and capture market share, Farfetch may have to make further investments in its infrastructure which may suppress margins for longer than expected.

Acquisition: Large, asset heavy acquisitions over the next 12 months may scare investors away. However we believe, given the current macro environment, the company is likely to focus on conserving cash instead.

Conclusion

Farfetch has manged to create a significant, technology-enabled platform in the luxury goods industry that is not easy to replicate. The company’s strategy of owning brands (although a departure from an asset light model) has the potential to add to shareholder value if executed in a measured way. Given the compressed valuation multiples coupled the company’s strong strategic positioning in the attractive luxury goods industry, the shares offer a compelling opportunity for long-term growth. As such, we’ve ranked Farfetch #8 on our recent Top 10 Growth Stocks (focused on “Post-Pandemic Realities”) list, ahead of our report on DocuSign (DOCU) at number 9. If you are looking for significant long-term price appreciation potential, Farfetch is worth considering.