Top 5 Credit Stocks: 9% Yields And Up

While our previous report (Top 15 New Reality Stocks) focused on companies that have been sailing through the coronavirus crisis, this report focuses on stocks that have sold-off, but have significant price appreciation potential, and that is in addition to their big, mostly double-digit yields. The Top 5 Credit Stocks in this report are all involved in the lending businesses (whether through small small business loans or mortgage securities, for example), and they are all attractive and worth considering. We count down the ideas from number five to number one.

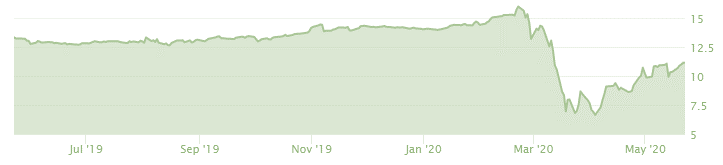

5. Hercules Capital (HTGC), Yield: 11.5%

Like most Business Development Companies (“BDCs”), Hercules Capital (HTGC) has been severely impacted by the current crisis, and its share price has plunged.

However, its sector exposures and balance sheet position suggest it may have a much easier time weathering this storm compared to other BDCs. The following article reviews the business, the ongoing COVID impacts, risks, liquidity, valuation, and management. We conclude with our opinion about investing in this big dividend BDC via its stock and its bonds. You can access the article here.

*Honorable Mention: Colony Credit (CLNC) (CLNY)

We are including Colony Credit (CLNC) on this list because the shares have the potential to absolutely soar—if the company can successfully weather the current market crisis. Colony eliminated its dividend recently because it is currently in balance sheet protection mode, but there may be light at the end of the tunnel in the form of very significant price gains.

We are keeping this one on our watch list. and you can access our Quick Look report here.

4. Starwood (STWD) Stock, Yield: 14.7%

Starwood Property Trust is one of the largest commercial real estate finance companies in the US. It has a strong management team and the backing of one of the largest private equity real estate funds. Additionally, while the company will face significant ongoing headwinds over the next six months (or longer) due to COVID-19, its strong balance sheet and comfortable “loan to values” will help Starwood absorb these shocks.

You can access our recent Starwood article here. and our previous quick look report here.

3. Starwood Bonds 2023, Yield: 9.1%

This one is technically a bond, not a stock, but as interesting as Starwood stock is—we find the bonds even more interesting. They are higher in the capital structure and backed by physical assets. Check out our CIO Noland Langford’s recent presentation on Starwood stock and bonds.

The Top 2

The top 2 stocks on this list offer attractive double-digit yields and significant price appreciation potential. And they are reserved for subscribers only (subscribers can access them here). We are also currently offering special Memorial Day pricing (this weekend only), for 20% off the standard subscription price (use coupon code: MD20). You can learn more about a subscription (and get instant access) here.

The Bottom Line

The coronavirus crisis has created attractive opportunities that don’t normally exist in the market. In particular, fear and panic have caused certain corners of the market to sell off indiscriminately, even considering some opportunities are significantly more attractive than others. We expect the market to stabilize over time, and we believe the investment opportunities we have highlighted are particularly attractive relative to the rest of the market.